National News

“November’s housing starts report signals strength for the housing market.” — First American deputy chief economist Odeta Kushi

In unveiling its predictions, the National Association of Realtors also released its top 10 housing-market “hidden gems” for 2022.

“While 2021 single-family starts are expected to end the year 24% higher than the pre-Covid 2019 level, we expect higher interest rates in 2022 will put a damper on housing affordability.” — NAHB chief economist Robert Dietz

The decline in mortgage rates prompted an uptick in refinancing, with government refinances increasing more than 20% over the week, MBA associate vice president of economic and industry forecasting Joel Kan said in a press release.

The REACH program aims to identify and accelerate the most promising new technology companies in real estate and adjacent industries, including banking, insurance and home services.

“Despite higher mortgage rates, purchase applications had a strong week, mostly driven by a 6% increase in conventional loan applications.” — MBA associate vice president of economic and industry forecasting Joel Kan

“If I had to choose only one word to describe September 2021’s housing price data, the word would be ‘deceleration. Housing prices continued to show remarkable strength in September, though the pace of price increases declined slightly.” — S&P DJI managing director Craig Lazzara.

The seasonally adjusted estimate of new houses for sale at the end of September was 389,000, representing a supply of 6.3 months at the current sales rate, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

The new REALTORS® Confidence Index survey is here, and thousands of Realtors have weighed in to reveal the current shape of the housing market.

The U.S. housing market kept firing on all cylinders, as the demand for residential real estate drove prices higher for the 116th month in a row, marking the longest streak on record.

November’s reading of 83 was up three points from October, driven by low existing inventories and strong buyer demand, the National Association of Home Builders reported, citing the latest NAHB/Wells Fargo Housing Market Index.

Housing observers noted that demand for housing remains robust despite the lack of new supply.

The National Association of Realtors® announced new, pro-consumer changes to its guidance for local Multiple Listing Service broker marketplaces.

Seventy-eight percent of the 183 U.S. markets monitored by the National Association of Realtors had double-digit increases in their median home prices, a decline from the second quarter, when 94% of markets saw double-digit increases.

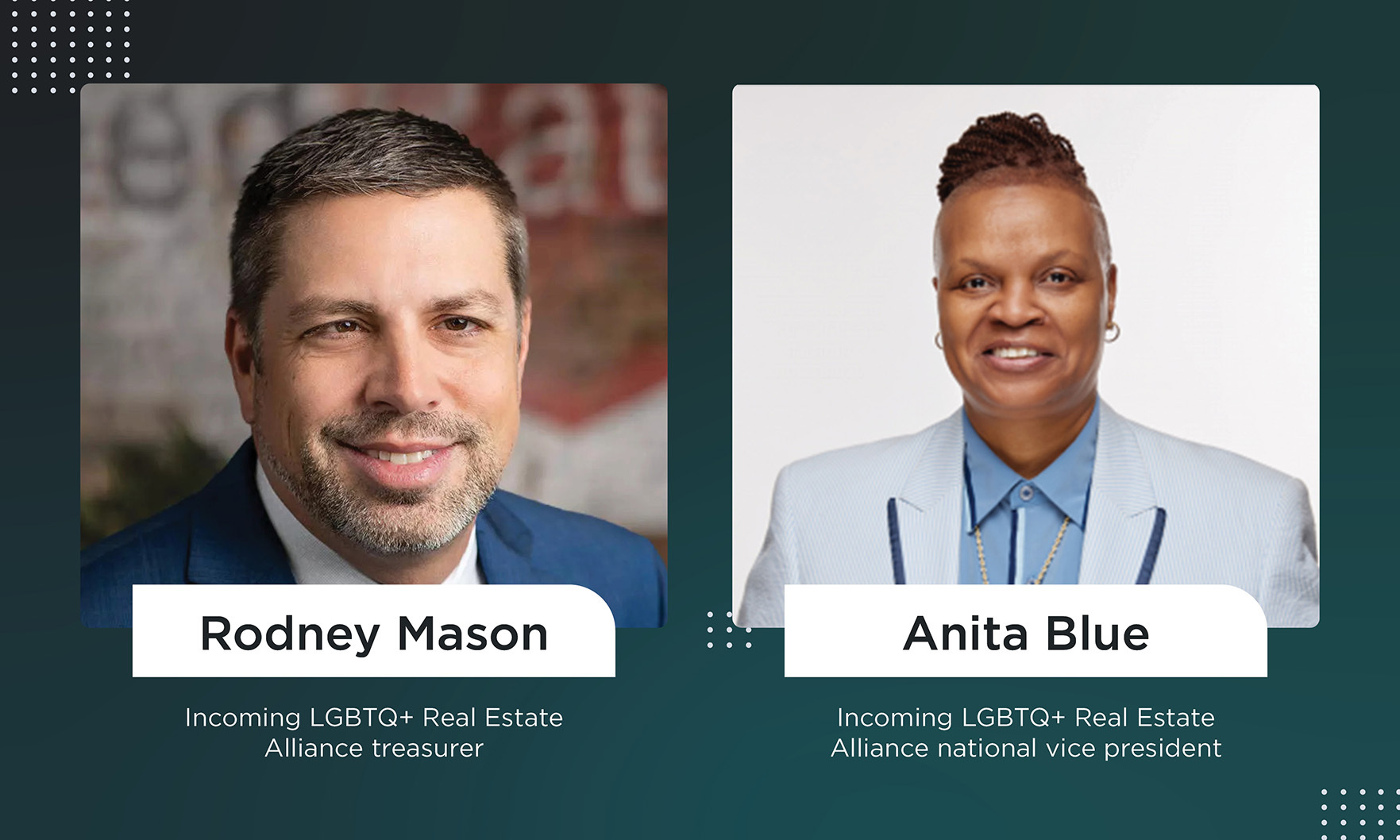

Atlanta’s Rodney Mason, who serves as vice president of mortgage lending with Guaranteed Rate, was named treasurer of the nonprofit, while Anita Blue, who works as an agent and credit restoration consultant at Cap Tex Realty, was named national vice president.

“Mortgage rates decreased for the first time since August, as concerns about supply-chain bottlenecks, waning consumer confidence, weaker economic growth and rising inflation pushed Treasury yields lower.” — MBA associate vice president of economic and industry forecasting Joel Kan