More than 85% of metro areas in the United States posted home-price gains in the fourth quarter of 2023, according to a new report from the National Association of REALTORS® (NAR).

Single-family home sales prices increased in 189 out of 221 metro areas analyzed, with the median single-family price in the country rising 3.5% year over year to $391,700. This is likely due to a healthy decrease in the 30-year fixed mortgage rate, which dropped from 7.79% to 6.61%.

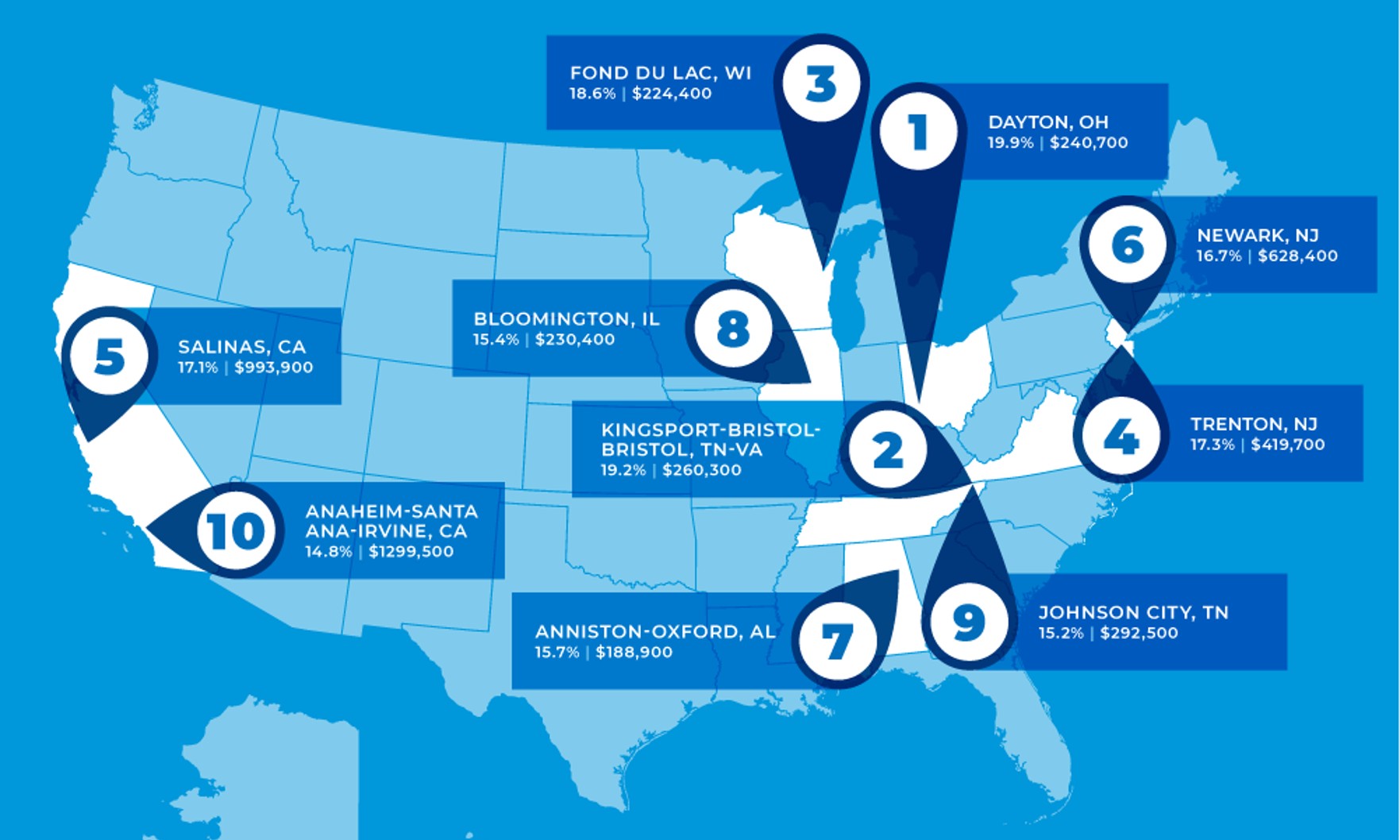

Furthermore, 15% of metro areas analyzed saw double-digit price gains, up from 11% in the third quarter. The greatest price increases were seen in Dayton, Ohio (up 19.9%); Kingsport-Bristol-Bristol, Tennessee-Virginia (up 19.2%); Fond du Lac, Wisconsin (up 18.6%); Trenton, New Jersey (up 17.3%); Salinas, California (up 17.1%); Newark, New Jersey-Pennsylvania (up 16.7%); Anniston-Oxford, Alabama (up 15.7%); Bloomington, Illinois (up 15.4%); and Anaheim-Santa Ana-Irvine, California (up 14.8%).

“Homeowners have benefitted from housing wealth accumulation. However, many homebuyers have been shocked at high housing costs, with a typical monthly mortgage payment rising from $1,000 three years ago to more than $2,000 last year,” said NAR Chief Economist Lawrence Yun. “This doubling in housing costs for recent homebuyers is not included in the official consumer price index inflation calculations and contributes to the sense of dissatisfaction about the economy.”

The South saw the largest increase in existing single-family home sales, accounting for 45% of all sales in the U.S. The largest price increase, however, was in the Northeast, where prices jumped 7.3% year over year, followed by the Midwest (up 4.7%) and the West (up 4.2%).

Less than 14% of markets saw home price declines in the fourth quarter, down from 17% in the third quarter.

Despite these widespread price increases, affordability improved slightly. The monthly mortgage payment on an existing single-family home with a 20% down payment decreased 1.2% to $2,163, down from $2,189 in the third quarter. However, that cost increased 10% — approximately $196 — year over year. That means the typical family spent 26.1% of their income on mortgage payments during the fourth quarter, down from 26.7% the previous quarter but up from 24.2% in the fourth quarter of 2022.

For first-time buyers, affordability remained constraining. For typical starter homes, valued at $332,900 with a 10% down payment, the monthly mortgage payment rose 9.8% year over year to $2,120. However, that cost decreased 1.2% from the third quarter. That means first-time buyers spent 39.4% of their income on mortgage payments during the fourth quarter, down from 40.3% the prior quarter.

Families still need a household income of at least $100,000 to afford a 10% down payment in nearly half of all markets in the U.S.