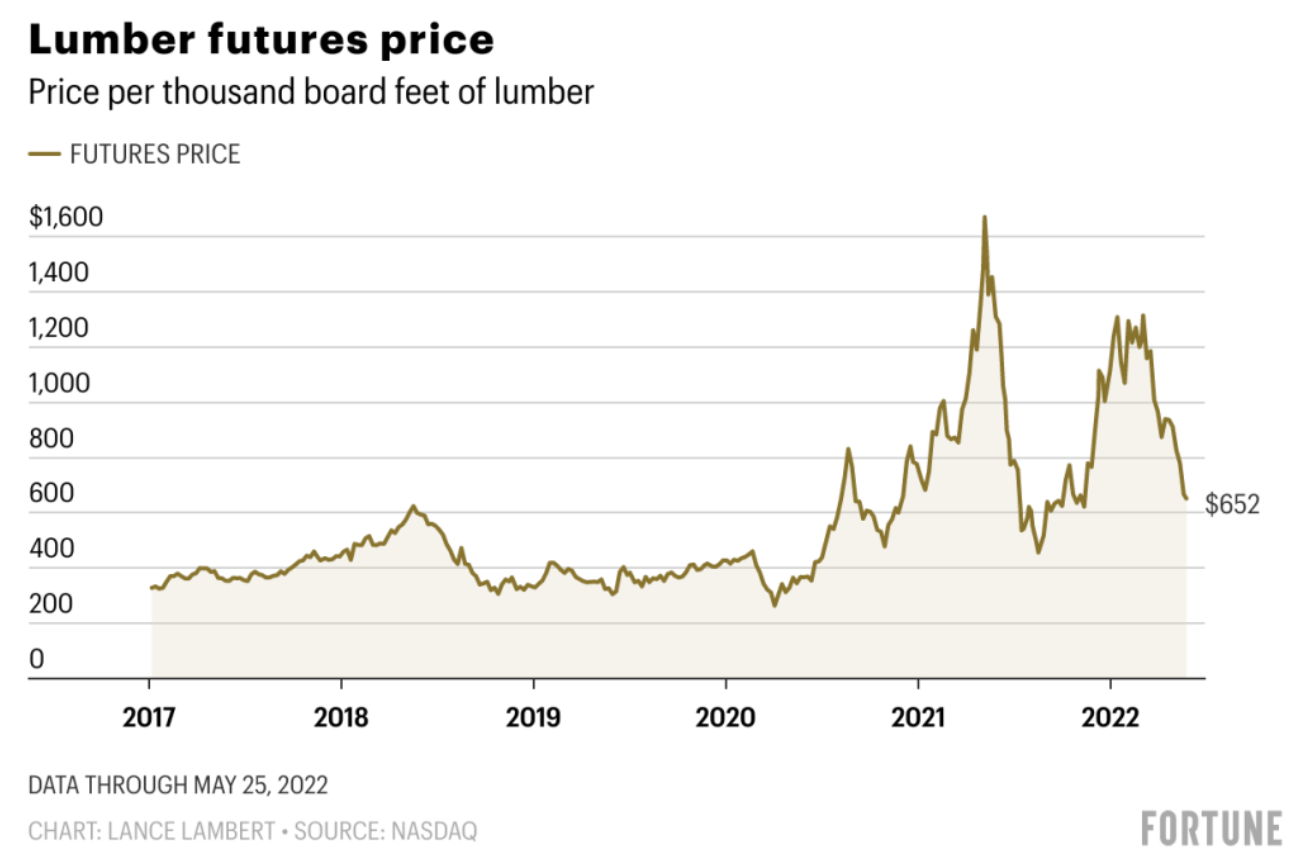

Last month, lumber prices fell more than 12% — reflecting a larger trend.

Since the onset of the pandemic, lumber inflation has been emblematic of widespread supply-chain woes. With the price of wood soaring to record highs, both homebuilders and homebuyers have felt the constraints. According to the National Association of Home Builders, lumber inflation has caused the price of a new single-family home to increase more than $18,600.

But, as interest rates rose over the last three months, lumber prices finally started to fall. Year over year, they are down 47%. And they are down 65% from the peak price seen in 2021: $1,733 per thousand board feet.

In turn, a lumber surplus is forming. Buyers are slowing their orders, wood is piling up and mills are slashing their prices, according to the Wall Street Journal. The outlet also stated that triple-digit discounts are now common, citing Random Lengths, a Fastmarkets RISI report.

Speaking to Fortune, a senior economist on Fastmarkets RISI’s lumber team, Dustin Jalbert, reflected on what the future demand will look like. “We have a hard time seeing … this sort of being like a housing bubble,” Jalbert said. “There’s still decent underlying demand that will support housing construction.” Overall, he predicts that prices will not collapse but hover between $450 and $600 per thousand board feet.

via Fortune